How Long Does It Take Insurance to Fix Car?

How long does it take insurance to fix your car after an accident? At CARDIAGTECH.NET, we understand the frustration and uncertainty surrounding auto repairs and insurance claims, so we want to help guide you through the process efficiently. Let’s explore the typical timelines, factors that influence repair duration, and how to navigate the insurance landscape for a smoother, faster resolution. This involves collision repairs, damage assessment, and claim settlement.

1. Understanding the Initial Insurance Claim Process

The first step after an accident is notifying your insurance company. This sets the entire repair process in motion. Knowing what to expect during this initial phase can help you prepare and expedite the subsequent steps.

1.1. Reporting the Accident

Immediately after an accident, ensure everyone is safe and call the authorities if necessary. Once the situation is under control, contact your insurance company to report the incident. Provide them with all the details, including:

- Date, time, and location of the accident

- Description of the accident

- Information about all parties involved (drivers, passengers, witnesses)

- Police report number (if applicable)

- Photos of the damage (if possible)

1.2. Claim Submission

Your insurance company will provide you with a claim number and the necessary forms to submit your claim. Complete these forms accurately and promptly. Include all relevant documentation, such as:

- Accident report

- Photos of the damage

- Repair estimates

- Medical reports (if any injuries occurred)

Submitting a complete and accurate claim will help avoid delays in the processing time.

1.3. Insurance Adjuster’s Role

The insurance company will assign an adjuster to assess the damage to your vehicle. The adjuster’s responsibilities include:

- Inspecting the vehicle damage

- Determining the extent of the damage

- Estimating the cost of repairs

- Negotiating with the auto body shop

- Approving the repair plan

The adjuster’s assessment is crucial in determining the amount the insurance company will pay for the repairs.

2. Factors Influencing the Repair Timeline

Several factors can affect how long it takes to get your car fixed after an insurance claim. Understanding these factors can help you anticipate potential delays and take proactive steps to mitigate them.

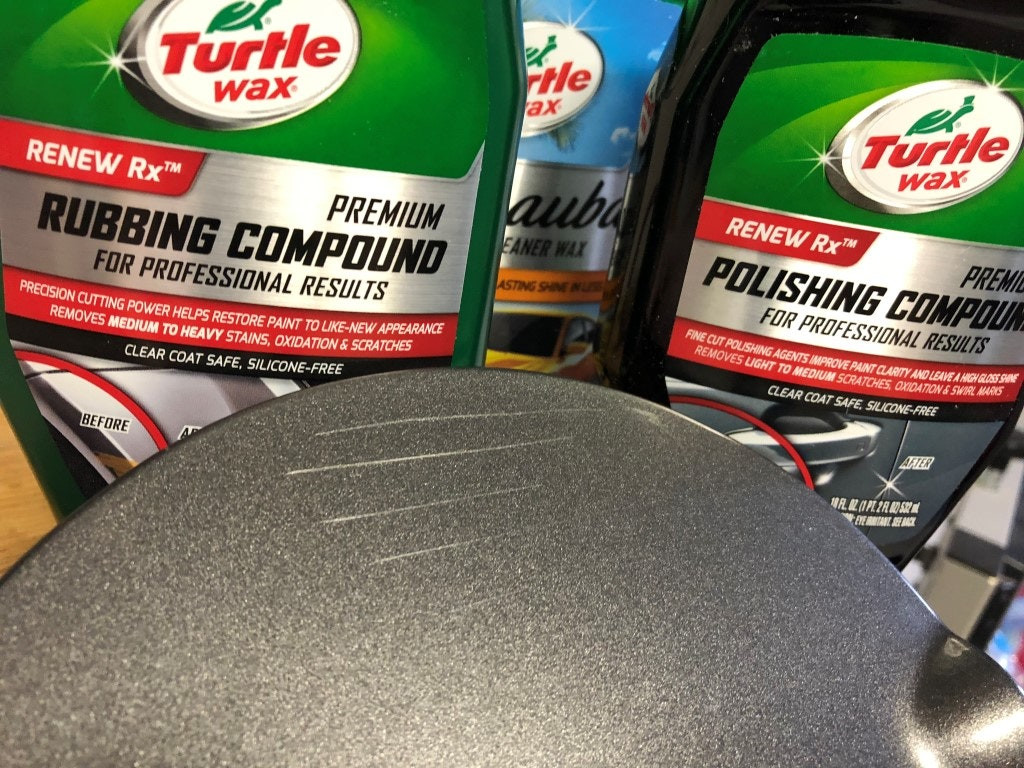

2.1. Severity of the Damage

The extent of the damage is a primary determinant of the repair timeline. Minor damage, such as scratches and dents, can be fixed relatively quickly. However, major structural damage requiring extensive repairs will naturally take longer.

- Minor Damage: Typically involves cosmetic repairs like paint touch-ups, small dent removals, and bumper realignments.

- Moderate Damage: Includes more significant bodywork, such as panel replacements, frame straightening, and component repairs.

- Severe Damage: Involves extensive structural repairs, such as frame reconstruction, airbag replacements, and engine repairs.

2.2. Auto Body Shop Selection

The choice of auto body shop can significantly impact the repair timeline. Insurance companies often have a network of preferred shops, but you have the right to choose any shop you trust.

- Preferred Shops: These shops have agreements with the insurance company, often leading to streamlined processes and potentially faster approvals.

- Independent Shops: These shops may offer specialized services and expertise but might require more time for insurance approvals.

Choosing a certified and reputable shop, like those recommended by CARDIAGTECH.NET, ensures quality repairs and adherence to industry standards.

2.3. Parts Availability

The availability of necessary replacement parts can also affect the repair timeline. Common parts are usually readily available, but rare or specialized parts may need to be ordered, causing delays.

- Common Parts: Typically in stock and easily accessible, such as standard bumpers, lights, and mirrors.

- Specialized Parts: May require ordering from manufacturers or specialized suppliers, leading to longer wait times.

- Backordered Parts: Can cause significant delays, especially for older or less common vehicle models.

2.4. Insurance Company Procedures

The insurance company’s internal procedures and workload can also influence the repair timeline. Factors such as adjuster availability, claim volume, and approval processes can all play a role.

- Adjuster Availability: Delays can occur if the adjuster is handling a high volume of claims or is unavailable for inspection.

- Claim Volume: Peak seasons or widespread accidents can increase claim volume, leading to slower processing times.

- Approval Processes: Complex or high-value claims may require additional approvals, causing further delays.

2.5. Additional Damage Discovery

Sometimes, hidden damage is discovered during the repair process. This can require additional assessments, approvals, and parts orders, extending the overall timeline.

- Hidden Damage: Includes damage not visible during the initial inspection, such as internal structural damage or corrosion.

- Supplemental Claims: Additional claims submitted to cover the cost of repairing newly discovered damage.

3. Average Timeframes for Car Repairs

While each case is unique, understanding average timeframes can provide a general expectation for how long it takes insurance to fix your car.

3.1. Minor Repairs

Minor repairs, such as dent removals, scratch repairs, and bumper replacements, typically take 1-5 days.

| Repair Type | Average Timeframe |

|---|---|

| Dent Removal | 1-2 days |

| Scratch Repair | 1-2 days |

| Bumper Replacement | 2-3 days |

| Paint Touch-Up | 1 day |

3.2. Moderate Repairs

Moderate repairs, such as panel replacements, frame straightening, and more extensive bodywork, can take 1-3 weeks.

| Repair Type | Average Timeframe |

|---|---|

| Panel Replacement | 3-5 days |

| Frame Straightening | 5-7 days |

| Component Repair | 2-5 days |

3.3. Major Repairs

Major repairs involving significant structural damage, airbag replacements, and extensive mechanical work can take 3-8 weeks or longer.

| Repair Type | Average Timeframe |

|---|---|

| Structural Repair | 1-4 weeks |

| Airbag Replacement | 2-5 days |

| Engine Repair | 1-3 weeks |

| Totaled Vehicle Claims | 2-6 weeks |

These are just estimates, and the actual timeframe can vary based on the specific circumstances of your case.

4. Steps to Expedite the Repair Process

While some factors are beyond your control, there are several steps you can take to help expedite the repair process.

4.1. Prompt Claim Submission

Submit your insurance claim as soon as possible after the accident. Provide all necessary information and documentation to avoid delays.

- Gather all relevant information immediately after the accident.

- Complete claim forms accurately and thoroughly.

- Submit the claim and documentation promptly.

4.2. Choose a Reputable Auto Body Shop

Select an auto body shop with a good reputation for quality work and efficient service. Certified shops, like those recommended by CARDIAGTECH.NET, often have streamlined processes for dealing with insurance companies.

- Research local auto body shops and read reviews.

- Choose a shop certified by your vehicle’s manufacturer.

- Ensure the shop has experience working with your insurance company.

4.3. Communicate Effectively with the Adjuster

Maintain open and clear communication with the insurance adjuster. Respond promptly to their requests and provide any additional information they need.

- Respond to the adjuster’s calls and emails promptly.

- Provide any additional information or documentation requested.

- Ask questions and seek clarification on any unclear points.

4.4. Obtain Multiple Repair Estimates

Getting multiple repair estimates can help ensure you receive a fair price for the repairs. Share these estimates with the adjuster to facilitate the negotiation process.

- Obtain estimates from at least three different auto body shops.

- Ensure the estimates are detailed and comprehensive.

- Share the estimates with the adjuster and discuss any discrepancies.

4.5. Understand Your Insurance Policy

Familiarize yourself with the terms and conditions of your insurance policy. Knowing your coverage limits, deductibles, and rights can help you navigate the claims process more effectively.

- Review your insurance policy carefully.

- Understand your coverage limits and deductibles.

- Know your rights as a policyholder.

5. Dealing with Insurance Company Delays

Despite your best efforts, you may encounter delays in the insurance claim process. Knowing how to handle these delays can help you stay proactive and resolve issues efficiently.

5.1. Follow Up Regularly

If you haven’t heard from the adjuster in a reasonable amount of time, follow up to check on the status of your claim. Regular follow-up can help keep your claim moving forward.

- Keep a record of all communication with the insurance company.

- Follow up with the adjuster every few days.

- Escalate the issue to a supervisor if necessary.

5.2. Document Everything

Keep detailed records of all communication, documents, and expenses related to the accident and the insurance claim. This documentation can be valuable if you need to dispute the insurance company’s decision or file a complaint.

- Keep copies of all claim forms, estimates, and correspondence.

- Track all expenses related to the accident, such as towing fees and rental car costs.

- Document any phone calls or conversations with the insurance company.

5.3. Understand Your Rights

Know your rights as a policyholder. Insurance companies have a duty to handle claims in good faith and within a reasonable timeframe. If you believe your claim is being unfairly delayed or denied, you may have legal recourse.

- Research your state’s insurance regulations.

- Consult with an attorney if you believe your rights have been violated.

- File a complaint with your state’s insurance department if necessary.

5.4. Consider Mediation or Arbitration

If you and the insurance company cannot reach an agreement, consider alternative dispute resolution methods such as mediation or arbitration. These processes can help you resolve the dispute without going to court.

- Mediation involves a neutral third party who helps you and the insurance company reach a settlement.

- Arbitration involves a neutral third party who makes a binding decision on the claim.

6. Navigating Direct Repair Programs

Many insurance companies offer Direct Repair Programs (DRP), which are networks of auto body shops that have agreements with the insurer. Understanding how these programs work can help you decide if they are the right choice for you.

6.1. Understanding DRPs

Direct Repair Programs are designed to streamline the repair process by connecting policyholders with pre-approved auto body shops. These shops typically meet certain quality standards and agree to specific pricing arrangements with the insurance company.

6.2. Pros of Using a DRP Shop

- Streamlined Process: DRP shops often have a direct line of communication with the insurance adjuster, which can speed up the approval and repair process.

- Guaranteed Repairs: Many DRP shops offer a warranty on their repairs, providing peace of mind.

- Convenience: DRP shops are often conveniently located and offer services such as rental car assistance.

6.3. Cons of Using a DRP Shop

- Potential Conflicts of Interest: DRP shops may feel pressure to keep costs down to maintain their relationship with the insurance company, potentially affecting the quality of repairs.

- Limited Choice: You may have a limited selection of shops to choose from within the DRP network.

- Negotiation Challenges: DRP shops may be less willing to negotiate repair costs or use aftermarket parts, as they are bound by their agreement with the insurance company.

6.4. Making an Informed Decision

Ultimately, the decision of whether to use a DRP shop is a personal one. Consider the pros and cons carefully, and choose a shop that you trust to provide quality repairs. Remember, you have the right to choose any shop you prefer, regardless of whether it is part of the insurance company’s DRP network.

7. The Importance of a Detailed Repair Estimate

A detailed repair estimate is a crucial document that outlines the scope of work, parts needed, and associated costs for repairing your vehicle. Understanding how to review and interpret this estimate can help you ensure that the repairs are necessary and the pricing is fair.

7.1. Components of a Repair Estimate

A comprehensive repair estimate should include the following information:

- Vehicle Information: Make, model, and year of the vehicle.

- Customer Information: Your name, address, and contact information.

- Shop Information: Name, address, and contact information of the auto body shop.

- Date of Estimate: Date the estimate was prepared.

- Description of Damage: Detailed description of the damage to be repaired.

- Parts List: List of all parts needed for the repair, including part numbers and prices.

- Labor Costs: Breakdown of labor hours and hourly rates for each repair task.

- Paint and Materials: Costs for paint, primer, and other materials.

- Sublet Repairs: Costs for any repairs that will be performed by a subcontractor, such as glass replacement or alignment services.

- Taxes: Applicable sales tax on parts and labor.

- Total Cost: Total estimated cost for the repairs.

7.2. Reviewing the Estimate

When reviewing the repair estimate, pay attention to the following:

- Accuracy: Ensure that the estimate accurately reflects the damage to your vehicle and the repairs that need to be performed.

- Clarity: The estimate should be clear and easy to understand. If you have any questions, ask the shop to explain them in detail.

- Reasonableness: The prices for parts and labor should be reasonable and in line with industry standards.

7.3. Negotiating the Estimate

If you believe that the repair estimate is too high or that certain repairs are unnecessary, don’t hesitate to negotiate with the auto body shop.

- Obtain Multiple Estimates: Getting estimates from multiple shops can give you a better sense of the fair market price for the repairs.

- Question Unnecessary Repairs: If the estimate includes repairs that you don’t believe are necessary, ask the shop to explain why they are recommending them.

- Negotiate Labor Rates: Labor rates can vary from shop to shop. If you believe the labor rate is too high, ask the shop if they are willing to negotiate.

- Consider Aftermarket Parts: Aftermarket parts are often less expensive than OEM (Original Equipment Manufacturer) parts. Ask the shop if they are willing to use aftermarket parts to save money.

7.4. Getting it in Writing

Once you have agreed on the scope of work and the price for the repairs, make sure to get it in writing. A written repair agreement will protect you in case any issues arise during the repair process.

8. The Role of Diminished Value Claims

Even after your car has been repaired, it may still be worth less than it was before the accident. This is known as diminished value, and you may be entitled to compensation for this loss.

8.1. Understanding Diminished Value

Diminished value is the reduction in a vehicle’s market value after it has been involved in an accident and repaired. Even if the repairs are performed perfectly, the fact that the vehicle has been in an accident can make it less attractive to potential buyers.

8.2. Types of Diminished Value

There are three types of diminished value:

- Inherent Diminished Value: The automatic reduction in value simply because the vehicle has been in an accident.

- Repair-Related Diminished Value: The reduction in value due to the quality of the repairs.

- Claim-Related Diminished Value: The reduction in value due to the stigma associated with a vehicle that has been involved in a major accident.

8.3. Filing a Diminished Value Claim

To file a diminished value claim, you will need to gather evidence to support your claim, such as:

- Photos of the Damage: Before and after photos of the damage to your vehicle.

- Repair Records: Detailed records of the repairs that were performed.

- Appraisal: An appraisal from a qualified appraiser that estimates the diminished value of your vehicle.

8.4. Negotiating a Settlement

Once you have gathered the necessary evidence, you can submit your diminished value claim to the insurance company. The insurance company may try to deny or minimize your claim, so be prepared to negotiate.

8.5. Seeking Legal Assistance

If you are unable to reach a fair settlement with the insurance company, you may need to seek legal assistance. An attorney can help you understand your rights and pursue your claim in court if necessary.

9. Common Pitfalls to Avoid

Navigating the insurance claim and repair process can be challenging, and there are several common pitfalls to avoid.

9.1. Accepting the First Offer

Don’t accept the insurance company’s first offer without carefully reviewing it. The initial offer may be lower than what you are entitled to.

9.2. Using Unauthorized Repair Shops

Avoid using unauthorized or unlicensed repair shops. These shops may not have the necessary expertise or equipment to perform quality repairs.

9.3. Failing to Document Everything

Failing to document all communication, documents, and expenses related to the accident and the insurance claim can make it difficult to prove your claim.

9.4. Delaying the Claim Process

Delaying the claim process can make it more difficult to gather evidence and negotiate a fair settlement.

9.5. Not Understanding Your Policy

Not understanding the terms and conditions of your insurance policy can lead to confusion and frustration.

10. The Role of CARDIAGTECH.NET in Automotive Repairs

At CARDIAGTECH.NET, we understand the challenges faced by auto repair professionals and vehicle owners alike. Our mission is to provide top-quality diagnostic tools and equipment that streamline the repair process, ensuring accuracy, efficiency, and customer satisfaction.

10.1. High-Quality Diagnostic Tools

We offer a comprehensive range of diagnostic tools that help technicians quickly and accurately identify issues, reducing diagnostic time and improving overall efficiency. These tools are designed to be user-friendly and provide detailed insights into vehicle systems, helping to pinpoint problems with precision.

10.2. Efficient Repair Equipment

Our selection of repair equipment is designed to make the repair process smoother and more efficient. From specialized tools for bodywork to advanced equipment for engine repairs, we provide the tools necessary to tackle any repair job with confidence.

10.3. Exceptional Customer Support

We are committed to providing exceptional customer support to help our customers get the most out of our products. Our team of experts is available to answer questions, provide technical assistance, and offer guidance on best practices for auto repair.

10.4. Partnering for Success

CARDIAGTECH.NET is more than just a supplier; we are a partner in your success. By providing high-quality tools, efficient equipment, and exceptional support, we help auto repair professionals deliver top-notch service and build lasting relationships with their customers.

Dealing with insurance companies and navigating the auto repair process can be complex. However, by understanding the steps involved, knowing your rights, and working with trusted professionals, you can ensure a smoother and more efficient experience.

Are you looking to enhance your auto repair capabilities and streamline your processes? Contact CARDIAGTECH.NET today at +1 (641) 206-8880 or visit our website CARDIAGTECH.NET. Our team is ready to assist you with expert advice and top-quality equipment. We are located at 276 Reock St, City of Orange, NJ 07050, United States. Let us help you elevate your service and exceed your customers’ expectations.

Frequently Asked Questions (FAQ)

1. How long does the insurance company typically take to inspect my car after an accident?

- The inspection process usually takes 4-5 days after you file a claim.

2. Can I choose my own auto body shop, or do I have to use the one recommended by the insurance company?

- Yes, you have the legal right to choose your own auto body shop.

3. What should I do if the insurance adjuster’s estimate is lower than the auto body shop’s estimate?

- You can negotiate with the adjuster, provide additional documentation, or seek a second opinion.

4. How can I speed up the repair process after filing an insurance claim?

- Submit your claim promptly, choose a reputable auto body shop, and communicate effectively with the adjuster.

5. What should I do if I discover additional damage to my car during the repair process?

- Notify the auto body shop and the insurance adjuster immediately, and submit a supplemental claim.

6. Is it possible to get compensation for the diminished value of my car after an accident?

- Yes, you may be entitled to compensation for diminished value.

7. What are Direct Repair Programs (DRP), and should I use a shop in the DRP network?

- DRPs are networks of pre-approved auto body shops. Consider the pros and cons before deciding.

8. How do I review and interpret a repair estimate to ensure it’s fair and accurate?

- Check for accuracy, clarity, and reasonableness of prices, and negotiate if needed.

9. What can CARDIAGTECH.NET offer to help with auto repairs?

- CARDIAGTECH.NET provides high-quality diagnostic tools and equipment to streamline the repair process.

10. What should I do if I am experiencing delays in the insurance claim process?

- Follow up regularly, document everything, and understand your rights as a policyholder.